CleanTech Lithium PLC (‘CleanTech Lithium’ or ‘CleanTech’ or the ‘Company’) (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, announces an updated resource estimate for its Laguna Verde project following the recent acquisition of additional licences at the project. Laguna Verde is one of the six salars selected by the Chilean Government to be prioritised for development by private companies.

Highlights:

- The mineral resource estimate is updated from that reported on 20 Jan 2025, based on the recent acquisition of additional licences at the project, as reported to the market on 11 Aug 2025

- The updated total resource is 1.9 million tonnes of Lithium Carbonate Equivalent (LCE), at a grade of 174 mg/L lithium, a 17% increase from the previous total resource of 1.63 million tonnes of LCE

- 0.84 million tonnes of LCE is in the Measured + Indicated category at a grade of 178 mg/L lithium

- The additional licences were acquired to meet the Government’s licence area requirement for entering the streamlined process for a Special Lithium Operating Contract (CEOL)

- The Chilean government is finalising the indigenous community consultations for Laguna Verde and it is expected that the streamlined process will be announced shortly afterwards

- The JORC (2012) compliant estimate was calculated by Montgomery & Associates (‘Montgomery´’ or ‘M&A’), a leading hydrogeological consultant highly experienced in lithium brine resource estimation

- The resource estimate is based on three years of annual exploration programmes completed by CTL from 2022 – 2024 including drill progammes, pump test programmes and geophysics surveys

- Montgomery recommends three additional drillholes in the southwest, north and northeast to potentially increase the resource

Ignacio Mehech, Chief Executive Officer, CleanTech Lithium said: ‘The updated JORC-compliant resource estimate for the Laguna Verde project, independently determined by Montgomery & Associates, confirms a robust and significant resource of 1.9 million tonnes of Lithium Carbonate Equivalent (LCE) at an average grade of 174 mg/l lithium, with 0.84 million tonnes in the Measured and Indicated category. The resource estimate is an important element of the project´s Pre-Feasibility Study which is advancing to completion. This positions Laguna Verde as a leading direct lithium extraction (DLE) based project in Chile’s lithium sector and as a future producer for the global EV and battery market.’

Further Details:

Background to Updated Resource Estimate

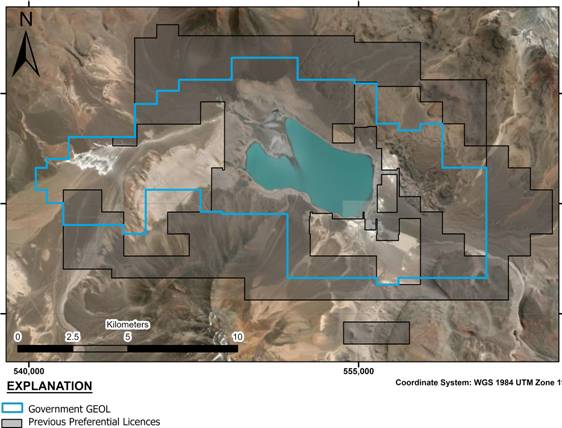

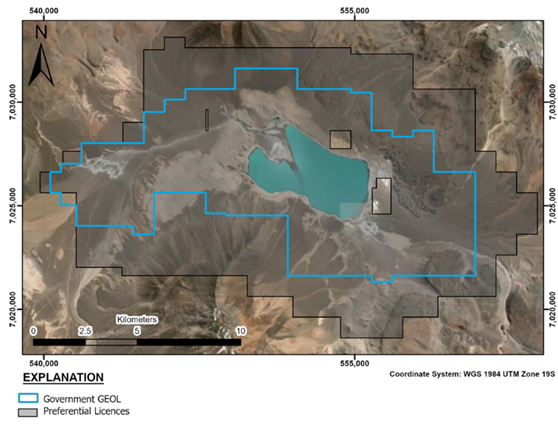

The previous total resource estimate declared for Laguna Verde of 1.63 million tonnes LCE was based on the CEOL polygon proposed by the Company. Of this total resource estimate, 1.21 million tonnes LCE was based on the Company´s preferential licence area within that polygon, and 0.42 million tonnes LCE was classified as provisional based on the total proposed CEOL area. In August 2025 the Company acquired an additional 30 licences from Minergy Chile SpA, with the primary objective of increasing the preferential licence position within the Government defined CEOL polygon as shown Figures 1 and 2. The acquisition increased the Company´s preferential licence position within the Government’s defined polygon to 97.6% of the area, exceeding a threshold of 80% required by the Government for consideration to enter a streamlined CEOL process for Laguna Verde. The updated resource estimate of 1.9 million tonnes LCE is based on the enlarged preferential licence area in Figure 2.

|

|

Fig 1: Previous Preferential Licence Extent & Govt. CEOL Polygon

Fig. 2: Post Acquisition Preferential Licence Extent

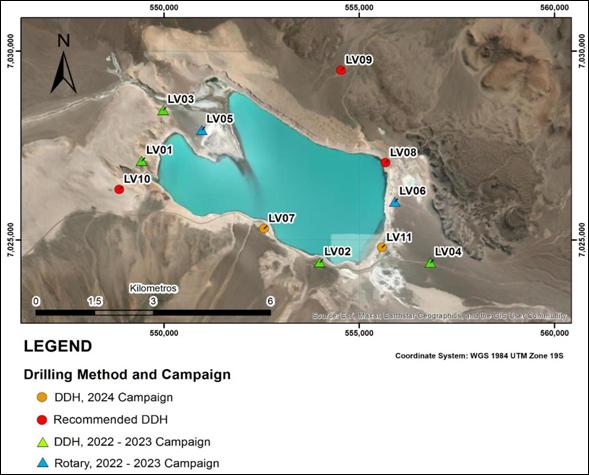

The resource estimate is based on annual exploration programmes completed by the Company between 2022 – 2024, in which rotary and diamond drill programmes were completed as shown in Figure 3. Additional observation wells were drilled to support observations during pump tests. Three additional diamond drillholes in the southwest, north, and northeast are recommended to potentially further expand the resource volume (LV08, LV09, and LV10).

|

Fig 3: Existing and Recommended Exploration Wells at Laguna Verde

Resource Summary

The technical report has been prepared by Montgomery to conform to the regulatory requirements of the JORC Code (2012). Mineral Resources are also reported in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Best Practice Guidelines (CIM, 2012). The breakdown of the resource categories comprising the total resource is provided in Table 1 below.

Mineral resources are not mineral reserves and do not have demonstrated economic viability. Furthermore, not all mineral resources can be converted into mineral reserves after application of the modifying factors, which include but are not limited to mining, processing, economic, and environmental factors.

Click here for the full release