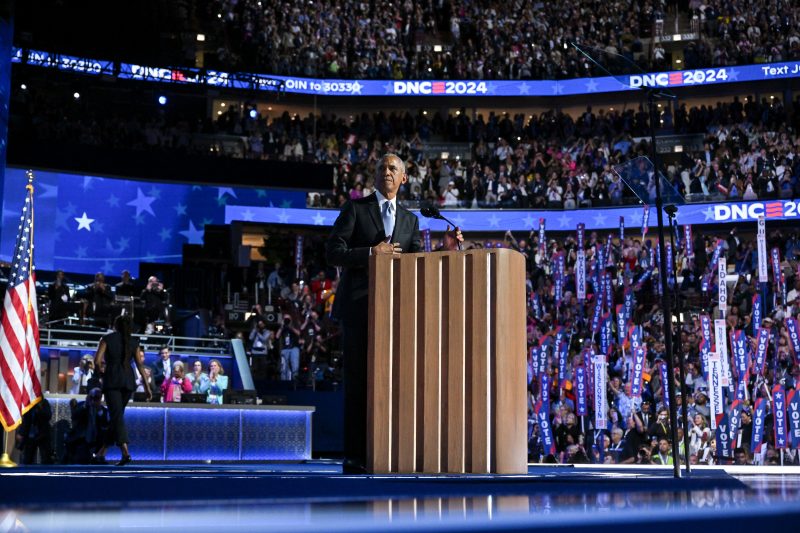

The second night of the 2024 Democratic National Convention in Chicago featured former president Barack Obama, former first lady Michelle Obama and second gentleman Doug Emhoff, among others, who made thematic speeches that required little fact-checking. Here’s a roundup of three claims that caught our attention, in the order in which they were made.

As is our practice, we do not award Pinocchios for a roundup of statements made during convention events.

“Under Project 2025, a family making just $75,000 a year with just two kids would pay 1,800 bucks more in federal taxes.”

— Malcolm Kenyatta, Pennsylvania House representative

This appears accurate. During the convention, Democrats have been highlighting proposals from a Heritage Foundation report called “Mandate for Leadership,” a 922-page manifesto chock full of detailed conservative proposals that is popularly known as Project 2025. It’s not an official campaign document, and former president Trump has distanced himself from it, but a CNN review found that 140 people who worked in the Trump administration contributed to the report.

One of the proposals would replace the current progressive tax system — which has seven tax brackets, at 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent — with just two brackets: 15 percent and 30 percent. Everyone making less than $168,000 (about the point when Social Security payroll taxes are no longer collected) would be subject to a 15 percent rate. The proposal also would eliminate most deductions, credits and exclusions.

While this would make the system simpler, it could also raise taxes for many people at lower income levels, as they currently pay federal income taxes at 10 percent and 12 percent. The current rate jumps to 22 percent after $94,300 for married couples.

Brendan Duke, senior director of economic policy at the left-leaning Center for American Progress, calculated that a family of four making $75,000 would receive a tax increase of $1,800. “My best guess is that the breakeven point — where a family of four goes from a tax increase to a tax cut — is about $170,000 when using the assumptions most favorable to Project 2025,” he wrote on X.

A Heritage representative did not respond to a request for comment.

“Within two months of taking office, our government did respond. We passed the American Rescue Plan, which provided $1,400 for every man, woman and child in the working class. We extended and expanded benefits for the unemployed. We provided emergency assistance for small businesses to stay open.”

— Sen. Bernie Sanders (I-Vt.)

This is half the story. Sanders extols the response of President Joe Biden to the pandemic but skips over the fact that Trump — whose response to the crisis was criticized as stumbling — in March 2020 signed into law bills that included stimulus checks of $1,200 and unemployment benefits. Trump also signed into law a bill in December 2020 that provided $600 checks — though complained they should have been $2,000. The bill signed by Biden made up the difference.

“Let me tell you what a radical agenda is. And that is Trump’s Project 2025. … Putting forth budgets to cut Social Security, Medicare and Medicaid is radical.”

— Sanders

This is misleading. Sanders slips in a mention of Social Security, but the old-age retirement program is only tangentially referenced in the Project 2025 report, and there is no proposal to do anything with it, let alone “cut” it.

The report contains some Medicare recommendations, mainly to promote Medicare Advantage plans, which are managed by insurance companies with federal funds. Just over half of Medicare beneficiaries are enrolled in Medicare Advantage, compared with traditional Medicare, which is run by the government and favored by Democrats. The 2025 proposals could have an impact on Medicare, but there is no call to cut funding.

Medicaid provides health care for the poor. Project 2025 does have a number of Medicaid proposals that could reduce spending, such as tighter eligibility standards and new work requirements.

(About our rating scale)

Send us facts to check by filling out this form

Sign up for The Fact Checker weekly newsletter

The Fact Checker is a verified signatory to the International Fact-Checking Network code of principles