Market participants braced for volatility on Monday (July 15), gravitating toward safe-haven assets following an assassination attempt on former US President Donald Trump over the weekend.

Gold closed at US$2,411.23 per ounce on Friday (July 12) and rose as high as US$2,433.32 on Monday (July 15).

The price of Bitcoin also increased, hitting a two week high of US$62,698.

Meanwhile, Trump Media & Technology Group’s (NASDAQ:DJT) share price leaped by 31.8 percent to close at US$40.58 on Monday. The company is owned by Trump and runs the social network Truth Social.

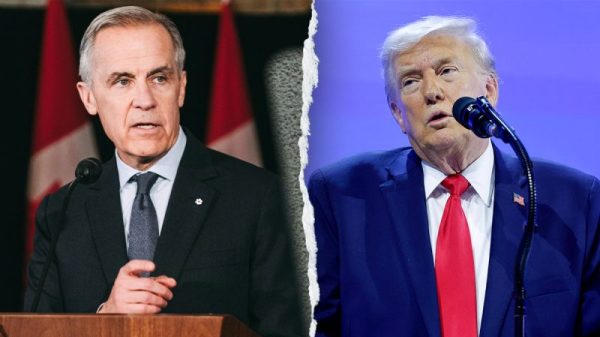

The assassination attempt occurred at a rally in Pennsylvania on Saturday (July 13). A shot hit Trump’s right ear, and he was quickly taken off stage; his campaign later reported that he sustained only a minor wound.

One rally attendee was killed, while two others were critically injured. The Federal Bureau of Investigation is treating the incident as an assassination attempt, and although the shooter has been identified, the investigation is ongoing.

Expect volatility for risk assets, market experts say

Speaking to Bloomberg after the incident, Frank Monkam, senior portfolio manager at Antimo, said it is likely to be the ‘grand opening’ for market volatility that will primarily affect risk assets.

On the flip side, safer sectors are likely to benefit, at least in the near term.

Quincy Krosby, chief global strategist at LPL Financial, explained this dynamic to Reuters, saying, ‘As with any geopolitical event underpinned by mounting concern or outright fear — especially given the opening of the Republican convention — gold would have a strong bid, coupled with a pickup in demand for Treasuries.”

The dollar, which has been softening due to the market’s perception that the US Federal Reserve may cut interest rates in September, could gain if the safety trade gains momentum, he told the news outlet.

Jack Ablin, chief investment officer at Cresset Capital, highlighted the aggravating role of political violence. ‘The specter of political violence introduces a whole new level of potential instability. It’s uncertainty and volatility, and of course markets don’t like that. The attempted assassination probably enhances Trump’s reputation for strength,’ he said.

For his part, Charles-Henry Monchau, chief investment officer at Banque SYZ, focused on the impact that the assassination attempt could have on election results. ‘Should the election become a landslide victory for Trump, this probably reduces uncertainty, which is positive for risk assets. Meanwhile, this could lead to more upward pressure on bond yields and a steepening of the yield curve,’ he commented to Bloomberg.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.