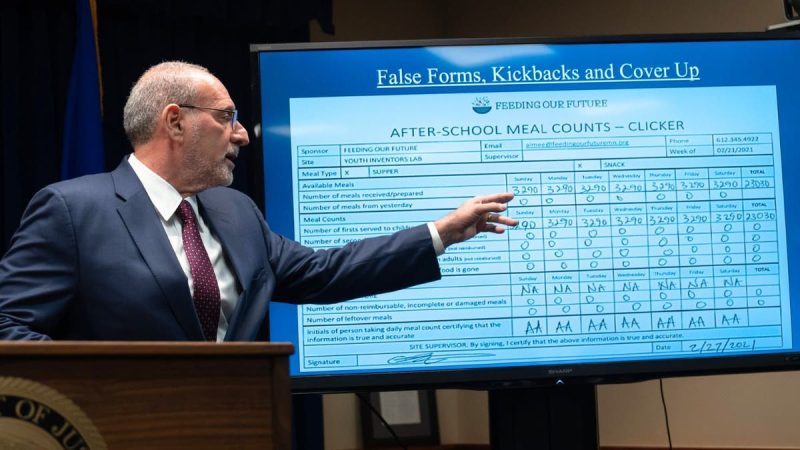

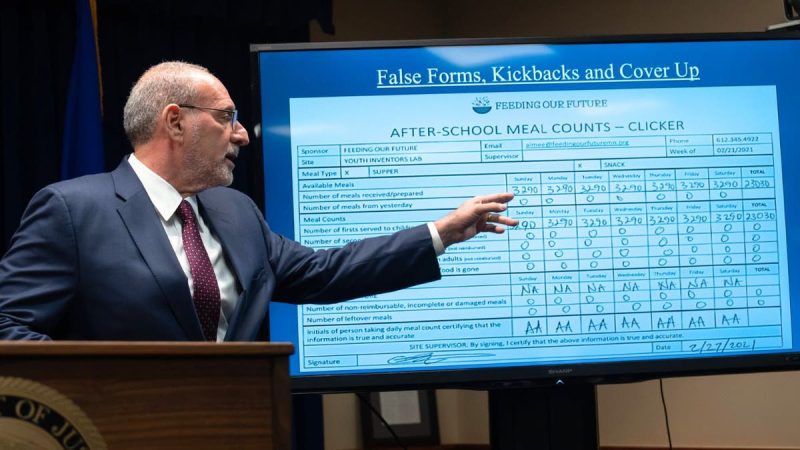

What had been a modest stream of taxpayer dollars to Feeding Our Future suddenly became a flood, surging 2,800% in a year, an abrupt spike now at the center of mounting scrutiny and oversight concerns.

The explosive growthoccurred during the COVID-19 pandemic, when the organization exploited a federally funded children’s nutrition program run by the Minnesota Department of Education (MDE), siphoning off money intended to feed low-income kids. It now stands as the nation’s largest COVID-19 fraud case.

Data from the Minnesota Office of the Legislative Auditor sheds light on how the scheme went unchecked for so long, finding that the MDE oversight was ‘inadequate’ and that its failures ‘created opportunities for fraud.’

State records chart the rise in payments and reveal how the fraud ballooned in plain sight.

According to data from the state audit, payments to Feeding Our Future began in 2019 at $1.4 million. That figure rose to $4.8 million the following year before topping out at $140.3 million in 2021, a staggering 2,818% increase.

Even before the pandemic, Feeding Our Future was already an outlier.

By the end of 2019, it sponsored more than six times the number of Child and Adult Care Food Program (CACFP) sites as its peers.

When federal nutrition dollars surged during COVID-19, that gap only widened. While funding to all meal sponsors increased, Feeding Our Future’s growth far outpaced the rest of the system.

According to the legislative auditor, in 2021, nearly four out of every 10 dollars sent to nonprofit meal sponsors in Minnesota flowed to Feeding Our Future alone.

Taken together, the numbers show that Feeding Our Future was expanding faster, adding more sites and collecting a vastly larger share of federal meal funds than any comparable organization, long before state regulators intervened.

And the oversight failures were just as striking.

Flawed applications sailed through, complaints were never investigated, and the nonprofit kept expanding despite repeated red flags.

What’s more, in the wake of a years-long $250 million welfare fraud scheme, Minnesota taxpayers will now finance a pricey state-level cleanup effort, effectively paying for the failure twice after state officials missed warnings.

Gov. Tim Walz of Minnesota has said in the past that he is ultimately accountable for the fraud that took place under his administration.